News

CARES Act Paycheck Protection Program May 7, 2020 Repayment Option

The Treasury Department posted updated Frequently Asked Questions (FAQs) on April 23, 2020. FAQ #31 deals specifically with large companies and whether...

Federal Reserve Authorizes Main Street Loans for Companies Impacted by COVID-19

Effective April 9, 2020, the Federal Reserve authorized a series of programs to provide up to $2.3 trillion in loans...

Economic Impact Payments: Beware of Schemes

We want to advise clients to be on the lookout for a surge of calls and email phishing attempts related...

CARES Act – Focus on Tax Provisions for Businesses & Individuals

On March 27, 2020, President Trump signed into law the Coronavirus Aid, Relief and Economic Security Act (the CARES Act...

Families First Coronavirus Response Act Tax Benefits and Employer Obligations

As the federal government searches for ways to combat the economic effects of the growing coronavirus (COVID-19) pandemic, the first...

The Setting Every Community Up for Retirement Enhancement (SECURE) Act

The Setting Every Community Up for Retirement Enhancement (SECURE) Act was signed into law on December 20, 2019. Many of...

Oregon Corporate Activity Tax (CAT) Update

Happy New Year! As we welcome 2020 and finalize our preparations for the upcoming busy season, we’d like to keep...

Oregon Passes New Corporate Activity Tax

Oregon’s landmark legislation House Bill (HB) 3427A (the “Student Success Act”) was passed by the Senate on May 13, 2019,...

The Wayfair Decision and Its Impact On Your Business

As Oregonians sales and use tax can sometimes feel like a foreign concept. We don’t pay it on the goods we purchase...

Unraveling the Latest Tax Reform and Its Effects on the Real Estate Industry

Recently, real estate industry leaders gathered in standing room only fashion at the PDX Live Studio to hear how tax...

2017 Federal & Individual Tax Reform Summary

You may have heard that both the House and Senate recently approved the final compromise tax reform bill. While most...

Oregon Legislature Passes $5.3 Billion Transportation Funding Bill

On July 6th, 2017 the Oregon legislature passed the $5.3 billion transportation package (Oregon House Bill 2017) which is expected...

PATH Act Update: Depreciation Provisions Clarified

This past April the IRS issued Revenue Procedure 2017-33 which provided additional guidance on several beneficial provisions of the Protecting...

IRS Tires of Valuation Disappearing Act

IRS Proposes Regulations Restricting Discounts on Family Transfers Experts have been able to assist families transfer wealth between generations using...

Identity Protection PIN Update

Last year we addressed the question, “Do I Need an Identity Protection PIN to File My Return?”, as the IRS...

TPR Update: Favorable Changes for Some Taxpayers

As we wrap up the second year in which the tangible property regulations (TPR) have been in effect, the IRS...

TPR Update: Small Businesses Need Not File Forms 3115

Last Friday the 13th was one to remember at Beacon CPA! After months of gearing up to prepare Forms 3115...

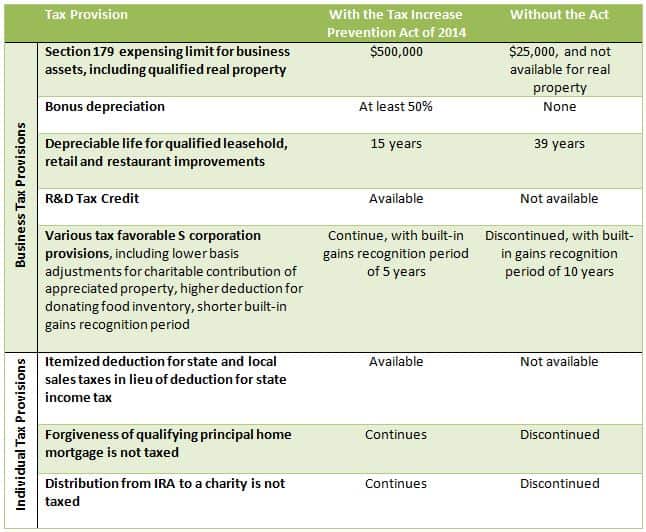

Congress Passed The Tax Increase Prevention Act of 2014

We held off writing our year-end message with hopes that Congress would provide clarity for taxpayers before 2014 is over....

AICPA Warning – Is your Employee Benefit Plan Auditor Qualified?

On December 3, 2014 the AICPA Employee Benefit Plan Audit Quality Center issued a Plan Advisory, The Importance of Hiring...

The New Tangible Property Rules Take Effect Now

As the expression goes, change is inevitable. This year, change in accounting method may also be inevitable. We’ve previously discussed...

Judge Overturns Oregon’s Same-Sex Marriage Ban

Federal judge Michael McShane ruled on May 19th that Oregon’s prohibition on same-sex marriage was unconstitutional. We devoted a lot...

Trusts and the 3.8% Medicare Surtax

Welcome to the wacky world of the new 3.8% Medicare Surtax! Did you know it also applies to trusts? As we...

Act Now or Pay Later: Unraveling the New “Repair” Regulations

The road to the final regulations has been an arduous one, and has involved significant revisions as the IRS solicited...

Oregon Recognizes Out-of-State Same-Sex Marriages

Despite Oregon’s continuing constitutional ban on same-sex marriages, the Oregon Department of Administrative Services announced today that all Oregon agencies...